Supply chain refers to the operational part of running a business, i.e. all of the processes necessary to making and distributing the goods or services the company sells. It does not include sales and marketing. It does not include administrative work or management. It is both critical to the success of any commercial endeavor despite being discounted by managers and investors. Here is a primer on procurement and RFPs for the 21st century.

Supply chain optimization is (or should be) a strategic priority for the executive suite. To quote Brian Laung Aoaeh further, “… supply chain is where companies win or lose competitive advantage.”

The earliest part of the supply chain is purchasing the inputs that go into production. This is a function called procurement. Companies in the United States spend roughly $7.3 trillion annually on purchases from third parties of goods and services. This translates to roughly 40% of revenue.

Companies want the best outcome. They optimize for something called “value for money”: buying the right thing from the right supplier at the right price. A key to improving margin through supply chain improvement is through the improvement of purchasing.

The current approach to sourcing dates back to the Industrial Revolution. It is essentially unchanged. EdgeworthBox is an order of magnitude improvement of the three components of value for money. We transform the character of procurement by introducing tools that work every day to facilitate millions of trades in compliance-intensive securities markets.

Having updated the business process, our ultimate objective is to automate it. This is a radical proposal. It is radical because we are going to change a business process that is central to the operation of every commercial organization in the world to extract massive supply chain efficiencies. In doing so, we free up staff to do things with greater impact on profitability.

However, the fundamental nature of this transformation is our biggest challenge at this stage. Without social proof, we must convince potential customers that our approach is worthwhile, even as they worry about the risk of negative disruption to their core operations.

This document will give you an overview of procurement and the RFP process, as well as highlighting the EdgeworthBox approach and how it differs from the myriad companies attacking this opportunity right now.

WHAT IS PROCUREMENT?

The procedure that we discuss is generally the same from organization to organization.

Every company will have its own set of rules and policies that govern the way to purchase goods and services from third parties. The procurement department is responsible for ensuring compliance with these rules and policies. Procurement officers in this group may or may not be involved directly with any individual purchasing act. The purpose of the rules and policies is to put into place best practices that the organization deems will ensure value for money: purchasing the right thing from the right supplier at the right price.

The procurement department may have a Chief Procurement Officer (or “CPO”) in charge. This confers the appearance, at least, of its strategic importance. Often, there is a Vice President of Procurement, instead, with senior procurement officers holding titles such as “Director of Procurement.” Whatever the leader’s title, the Procurement department can report to the Chief Operating Officer, the Chief Financial Officer, or the Chief Technology Officer. The reporting line depends on the sophistication of the organization and the degree to which the company has digitized this business process.

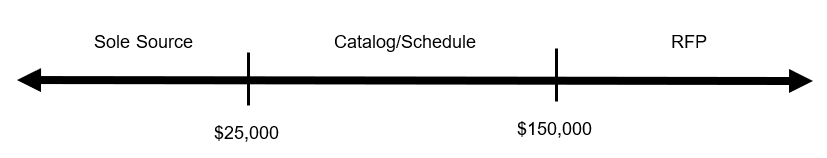

There is a spectrum of procurement with three sections defined by the size of the purchase. The thresholds in the diagram below vary from organization to organization. These are samples.

The central underlying assumption of procurement is that competition is most likely to generate value for money. However, there are circumstances in which requiring competition may not be feasible or economically worthwhile.

Sole source purchasing means that anyone in the organization who has a budget can use their discretion to purchase goods and services without soliciting bids in competition. For example, a manager may purchase, on a one-off basis, consulting services from an individual with specific domain expertise as long as the cost is below the sole source threshold. This makes sense potentially because the individual has unique knowledge. Generally, sole source is appropriate where it would cost more money to run a competitive process than any putative improvement in value for money.

The middle part of the procurement spectrum which I describe as “Catalog/Schedule” is sometimes called “Negotiated Acquisition.” The Canadian government refers to this technique as “Standing Arrangement.” The value of the purchased items is high enough to merit some limited negotiation.

Consider a large corporation, “MegaCorp”, that buys computers occasionally to build out data centers around Canada and the US. MegaCorp will identify, vet, and engage a set of vendors of record and negotiate special MegaCorp discounts to the list pricing of each. The manager looking to purchase computers logs onto the MegaCorp website, navigates to the computer section of the internal acquisition portal, and finds links to three catalogs, one for each of three preferred vendors. He clicks on the Lenovo link and it takes him to what is called a “punch-out” catalog. This is a subset of the same catalog of computers that Lenovo has on their public website, but the prices are different. The prices reflect discounts that the MegaCorp procurement department has negotiated with Lenovo in exchange for a promise of a certain volume of low effort sales to MegaCorp. He puts what he wants into a cart and checks out. MegaCorp’s corporate enterprise resource planning software facilitates the billing and payment.

Alternatively, there may be a third-party that acts as a reseller by making available a catalog made up of SKUs from different suppliers. One example of this is a company called CDW. The buying organization has contracted with the reseller to act as a channel for suppliers that are not large enough or significant enough to merit their own catalog. Ostensibly, the reseller negotiates prices and manages vendors on behalf of the buyer in exchange for a service fee. Part of the reseller’s pitch is that they are performing this service for multiple buyers and they have consequent negotiating leverage. In using the reseller this way, the buyer’s procurement department simplifies their own workload by reducing the number of small suppliers to manage directly. In addition, the supplier pays the reseller a fee to list in the catalog, as well as a percentage of the revenue from every transaction effected through the reseller’s catalog. This percentage can range from 10% to 20% of the price paid by the end buyer.

In practice, the supplier inflates their price to incorporate the third-party fee, so that the buyer ends up paying a price that is 10% to 20% higher than if they were to purchase directly. The 10% to 20% inflation in price is the economic cost the buyer pays to outsource part of the procurement function to the third-party reseller, like CDW.

The upper end of the spectrum is the request for proposal part of the spectrum. An RFP is a reverse auction in which the buyer, MegaCorp, uses a document to solicit multiple competitive proposals from suppliers in the relevant market. The RFP can be broken into two sections: a Statement of Work (or “SOW”) and everything else. The SOW describes the problem the company is trying to solve with the acquisition, some historical context, and often a description in detail of an acceptable solution. The other parts to the RFP refer to the administration of the reverse auction including details on such things as the procedure for responding, the dates for specific milestones, the contact information for the procurement officer, etc. The buyer will tell the suppliers explicitly what the criteria are for selection in an appendix to the RFP, e.g. lowest price, prior history, etc.

There is a nascent trend towards outcome-oriented RFPs in which buyers do not describe the solution they seek to purchase. Instead, the buyer describes only the problem they want to solve in order to solicit a wider spread of responses.

MegaCorp will review the submitted proposals and pick the supplier with the most attractive proposal. This doesn’t mean that MegaCorp will automatically purchase at the terms in the winning proposal. Instead, MegaCorp will begin negotiating a final contract with the winning bidder. (It is called a “Tender” in the case where acceptance of the proposal constitutes an automatic and binding contract.)

We will discuss the RFP process in greater detail below with an example of the process.

Also note that another way people within the gaming organization game the system is by chopping up projects that should be acquired via RFP into a series of smaller contracts that they execute using a third-party reseller catalog. They pay the higher price, reflecting the fees the reseller imposes, transforming a competitive auction into effectively a sole source purchase. This, in a sense, is fraud.

It is important to understand terminology.

The term “procurement” is ambiguous and often confused in its application. It may refer to the whole spectrum of purchasing goods and services. It may refer to sole source and catalog purchasing. It may refer to the organizational department of procurement officers as in “you’ll have to go through procurement before I can get approval.”

Sourcing refers to the process of finding someone to sell you something and then executing the acquisition. Strategic sourcing refers to the RFP or Tender processes; acquisitions above the high threshold are presumably for goods and services with long-lasting or otherwise important consequences for the organization. Tactical sourcing refers to sole source purchasing and catalog spending. Tactical sourcing and procurement are terms that are used interchangeably.

Source-to-pay systems are technology tools that permit people to combine the sourcing act (either strategic or tactical) with downstream processes including contracting, invoicing, and payment. They may also include contract management in which buyers periodically assess the performance of their suppliers to ensure that they are getting the full value for which they bargained intensively during the sourcing process.

Procure-to-pay systems are like source-to-pay systems but they are restricted only to sole source and catalog purchases.

As we will describe below, there is a workflow for executing an RFP on both the buyer side and the supplier side.

EdgeworthBox is focused on the RFP process. We will describe how our approach to RFPs can enable us to penetrate the full procurement spectrum.

HOW DOES THE RFP PROCESS WORK?

We’ll describe the way the RFP process works with an example. This example is typical of the experience of many companies. You will see that there are three parts to the RFP cycle: generating the RFP, generating the supplier’s response, and evaluating the finally submitted proposals.

MegaCorp decides that it needs to buy a new fleet of trucks. The dollar value of these new trucks triggers an RFP process. A committee chaired by the COO recommended this decision to the CEO and the CFO. It’s not big enough to take to the Board of Directors, so the CEO instructed the procurement to go forward.

The CFO contacted the Vice President of Procurement, instructing her to start the process. Simultaneously, the CFO identified a line manager, Bob Smith, to lead the procurement. Bob is a senior manager in the supply chain organization that will use the trucks once they are purchased.

Bob meets with the Vice President of Procurement and one of her managers, a Director of Procurement named Jill Jones. The Vice President of Procurement tells them that Bob and Jill together will lead the strategic sourcing of the new trucks, subject to the oversight of a committee. The committee includes the CFO, the COO, and the Vice President of Procurement, as well as Bob and Jill.

Bob isn’t happy about having to do this RFP. He is busy enough as it is with his principal job. Bob and Jill meet to discuss the plan. Jill is there to help run the process and to ensure that the company complies with MegaCorp’s procurement policies. She knows a little about the truck market, but not much. Bob has never purchased trucks at this scale.

Jill points out that they do not have a budget for market research. Consultants with deep domain expertise in the truck market could give them information about vendors, key criteria buyers use in selecting trucks and suppliers, trends in truck features, or a sense of the kind of price they should pay. Bob and Jill don’t have this option.

They have limited access to the company’s RFP information from the last time MegaCorp bought trucks because the prior team relied on spreadsheets and email. Neither of the two prior team leads work for the company any longer and there is no central repository of structured data. The spreadsheets are indecipherable and the emails are not accessible.

However, as part of that prior evolution, they had a number of truck suppliers qualified as vendors of record. The information MegaCorp has in their vendor management system is stale (and potentially incomplete). But at least they know who some of the truck suppliers are.

The more he learns about the situation, the more frustrated Bob becomes, especially when Jill tells him that this buyer workflow will likely take six months to complete, including the following steps:

- Research the truck market

- Get a sense for internal requirements (e.g. performance tolerances)

- Identify a list of relevant truck suppliers

- Onboard the truck suppliers as vendors of record by requesting them to disclose up-to-date vendor risk management information

- Write the Statement of Work

- Wrap the Statement of Work with the procurement rules to create the RFP

- Get approval to issue the RFP from the MegaCorp committee

- Send the RFP to a number of suppliers

- Review the final proposals from the suppliers

- Score the supplier responses according to the framework in the RFP

- Recommend to the committee a vendor with whom to negotiate a contract

It is daunting. Bob jumps right in.

He visits the websites for some truck suppliers. They can tell when he has visited, in part because they have restricted access to some of their most relevant content to only those who fill out a form providing their contact information.

Ford is one of the vendors that requires visitors to fill out a form before they can get access to the content. Bob fills out the form. Ford now knows that a) MegaCorp is in the market to buy trucks and b) Bob is the contact (and likely the principal or someone working for the principal). Bob is now a qualified lead for Ford.

The Ford marketing department hands this information off to sales with some notes. Jane Givens, a Ford saleswoman, reaches out to Bob and schedules a call. During the call, she asks a number of questions of Bob to understand the context for his interest in trucks. She then volunteers some information, adding value in the form of free consulting. Of course, this information is skewed to emphasize aspects of trucks at which Ford excels and to downplay things that Ford doesn’t do so well.

If Jane can get Bob to trust her sufficiently, she may even be bold enough to suggest writing a first draft of the SOW for him. All of this (the focused questions, the free consulting, the writing of the SOW draft) is called “shaping” the RFP.

Bob agrees to let Jane write the SOW for him. Perhaps he justifies it to himself that it is just an input, a starting point, for his own work. But the path of least resistance when he receives it from Jane is to just use what she has written.

Bob and Jill agree to use Jane’s SOW, albeit with some small, cosmetic changes. Jill wraps the SOW with the rules and procedures that MegaCorp uses for executing an RFP cycle and they present it to the committee for virtual approval.

In parallel, Jill has been identifying potential truck suppliers and updating their vendor management information in the vendor management system. This might be part of the enterprise resource planning (or “ERP”) system that MegaCorp uses firmwide, or a standalone service for vendor risk management. In practice, often it is just a very elaborate spreadsheet.

Once the MegaCorp committee has signed off, Bob and Jill will review the list of vendors of record and decide which ones merit seeing the RFP. Jill then sends the RFP to them, identifying herself as the principal point of contact. Suppliers will contact her with questions. She will periodically email all the interested suppliers with a list of frequently asked questions and the associated answers.

Suppliers receive the RFP and then must decide whether to respond by convening their own bid/no-bid committee, made up of people from sales, finance, and product. They read the RFP to decide whether to make the investment of thousands or tens or hundreds of thousands of dollars for an uncertain outcome. The committee makes its decision based on its appraisal of the time to sale, the margin they can earn if they win, the overall relationship with the buyer, and their likelihood of winning. In a strong economy when capacity is near full utilization, many suppliers will not submit a response unless there is an 80% or better subjective assessment of the probability of winning the business.

If they decide to bid, suppliers must execute their own workflow, allocated among members of an ad hoc committee they assemble for the purpose:

- Separate the SOW into a list of questions to answer

- Verify consensus that they have identified all of the questions and done so correctly

- Extract the operational steps they need to execute from the rules part of the RFP

- Assign the questions to relevant individuals

- Answer the questions

- Convene to review the answers as a group, including making a final determination on price

- Revise the answers

- Reassemble the answers into a coherent prose response

- Complete the operational steps

- Submit the proposal

The final workflow is for the buyers to execute, upon receipt of the bid submissions.

- The RFP team leads read each of the bid documents, scoring them individually

- The RFP team leads meet to finalize the scores for each of the proposals

- The RFP team leads present to the buyer committee, recommending the vendor with the highest score

- The buyer committee selects one of the suppliers with whom to start negotiating (not necessarily the one with the highest scored ranking)

- Complete negotiations

- Sign a contract

This is a simplified example of what an RFP entails. One can see how complicated the process is and imagine the complex interactions with other aspects of the buyer’s business or the supplier’s business.

The next sections will describe the problems that stem from the fact that people on both sides twist themselves to try to overcome the cumbersome bureaucracy.

WHAT ARE THE KEY CHALLENGES OF THE RFP FOR THE BUYER?

Recall that buyers want to optimize for value for money: buying the right thing at the right price from the right supplier.

EdgeworthBox is predicated on the fact that the RFP process as it is executed currently by most companies fails on at least one of those three criteria.

When we talk to buyers about their RFP experience, they complain that the bulky business process takes too long and that they don’t receive enough supplier proposals. (Some organizations are so familiar with this problem that they have rules in place requiring them to cancel the project and start over if they do not receive more than a minimum threshold number of bids.)

Asking them about the consequences of not getting enough proposals is even more revealing. There are two issues with not getting enough bids.

The first is that it is less likely that the suppliers who do respond will do so with a competitive price. If the suppliers can guess (or even know) that other suppliers are unlikely to bid, then why bid aggressively?

The larger problem is that the buyer does not see the full gamut of solutions to the problem that the RFP is intended to fix. Let’s say that there are 100 potential respondents to an RFP. Of those 100 companies, only 3 directly and completely solve the problem; the other 97 solve the problem, but incompletely. If none of the three direct solutions submit proposals, then the buyer will have to pick one of the other 97. This happens frequently.

So, the RFP is neither delivering the right price nor getting the right thing. The RFP process is causing the buyer to overpay for a second-best solution.

If there are any issues with the vendor management process and the identification and management of vendor risk, the buyer may be purchasing from a vendor who adds risk to the buyer’s supply chain.

Moreover, chances are that the bureaucracy, the length of the sales cycle, and restricted access to the procurement staff have made it more difficult for small and medium sized businesses, as well as businesses owned by minorities, women, veterans and other members of historically disadvantaged groups, to participate.

So, they fail to buy from the “right supplier” in an important social responsibility sense, as well.

Furthermore, the buyer has little access to market information. Most of the time, there is no budget for market research. They don’t know what they’re supposed to be buying and they don’t know what they should be paying. There is no “tape” like in a financial market. Benchmarking services cost money. They also don’t have access to buyers of similar items in other organizations.

Many buyers are too small to merit the pain of responding to an RFP for the supplier. The upside just isn’t there. So why submit a proposal?

Finally, because the RFP process is so intensive, the procurement staff spend too much time on it. They could be spending this time more productively on downstream activities like contract management or on identifying and inoculating risks in the supply chain. But they can’t.

So, even if the buyer did manage to purchase the right thing from the right supplier at the right price, the buyer’s procurement team is so stretched managing the cumbersome RFP process that they don’t have the time to monitor performance, ensuring that they got what they paid for. It is easy to imagine suppliers who can game the system to win the business but fail to deliver and still get paid. We have even heard of stories of suppliers who fail to perform and then move on to other buyer clients without the new buyer having any sense for the vendor’s true ability to deliver.

All of this is amplified by the difficulties in recruiting, training, and retaining good procurement staff today.

WHAT ARE THE KEY CHALLENGES OF THE RFP FOR SUPPLIERS?

When we ask suppliers what they think of the RFP process, they have a laundry list of complaints that explain why they don’t submit proposals.

First, it is very difficult to get set up as a vendor of record. Every buyer has a slightly different version of the duplicative, mind-numbing process. Some of them are more onerous than others, but the entropy all moves in the direction of more requirements. Why wouldn’t it? The coronavirus pandemic of 2020 illustrated in stark relief how supplier problems can ripple through a business with cascading and potentially devastating effect. Vendor management due diligence seeks to identify supplier risks early and upfront so the buyer can either reject the vendor or take steps to mitigate the risks. IBM sums it up well:

“In most companies, supplier onboarding warrants a complex process with multiple steps and multiple interactions with the suppliers. In our own procurement, there are approximately 70 steps and requires more than 35 days to onboard a new supplier into our systems. We have also discovered that a large portion (around 80 percent) of the information that multiple buyers request from individual suppliers remains the same.”

Second, suppliers often don’t know when buyers are in the market.

If a supplier is a vendor of record and the buyer sends them the RFP, then the supplier will know if the buyer is in the market.

However, many relevant suppliers are unknown to buyers, including suppliers who may have the direct solution to the problem the RFP putatively poses.

Even for the vendors of record, buyers may not know accurately and comprehensively what their suppliers actually do. Buyers may send irrelevant RFPs to suppliers. Or buyers may decide mistakenly not to send an RFP to a vendor who sells exactly what the buyer is looking for.

Third, it is expensive to respond to an RFP. There are more layers of rules and bureaucracy as buyers try to push risk onto suppliers, or hedge by asking for often extraneous information that has little or no bearing on the RFP’s central issues. The more risk averse the buyer, the more expensive it costs to respond to an RFP.

TechRepublic takes a stab at answering the question of how much it costs vendors to respond to RFPs with an infographic. They argue that suppliers spend several hundreds of thousands of dollars on responding to RFP annually, on average. If they can, they pass those costs onto the buyer. Of course, doing so is only possible if there is not a competitive dynamic.

Fourth, the biggest obstacle suppliers identified to submitting a proposal is the conclusion, correct or not, that the RFP is “wired” for a specific supplier already. That is, the language in the Statement of Work is written in a way that indicates to an educated market participant that the buyer has decided the supplier they want to use already, engaging in a pro forma process to appear to comply with their organization’s rules.

Think of the prior example in which Jane wrote the SOW for Bob. She would have done so emphasizing things that Ford is good at and de-emphasizing factors for which Ford’s competitors were superior. Other suppliers will read the RFP and know that it was written in favor of Ford.

Knowing that the RFP is “wired” for Ford means that Jane’s doesn’t need to price competitively. Whether they call it this or not, it’s a form of bid rigging, a type of procurement fraud. This outcome is little different than if Bob had decided not to execute an RFP and select Ford on a sole source basis. In a sense, Bob defrauds his own company. It is also a form of procurement fraud to entice suppliers who have no chance of winning into spending thousands of dollars on a doomed proposal.

SAS Research says that roughly one third of businesses in the UK have fallen victim to a form of bid rigging.

HOW DOES EDGEWORTHBOX CHANGE THINGS?

While cognizant of the risks that buyers face in managing their supply chains and mindful of the key underlying assumption that competition is most likely to generate value for money, EdgeworthBox uses tools from financial markets to overcome the key challenges both buyers and suppliers face.

For buyers, the key imperative is to get more suppliers to submit proposals in order to generate greater competition on price and solution.

To do this, we need to make it easier and far less expensive for vendors to respond. We need to make it easier and far less expensive for buyers to put together quickly a well-informed, fair RFP without being influenced by any suppliers. And we need to collapse the time it takes to do all of this.

First, we make vendor management massively simpler. Instead of one-to-one interactions with all of their potential buyer clients, suppliers engage with us for a one-to-many business process. They fill out the vendor management information in our “common application” and keep all of the supporting documentation in a locker on EdgeworthBox. When a buyer wants to onboard them, the supplier grants them access to their information on EdgeworthBox instantaneously. The common application acts to standardize vendor management. This may be something we need to tailor for particular categories. One can imagine a scenario in which a buyer posts an RFP for all of the suppliers on the platform who are in the market for the item in the RFP, some of which he may not have onboarded previously. If he selects as superior the bid of one of the suppliers with whom he has no antecedent relationship, the buyer can go through our central clearinghouse for administration and vet the supplier rapidly. This is an approach we borrowed from the European Union’s TED system.

Second, we make it easy for suppliers on EdgeworthBox to receive relevant RFPs. When a buyer posts an RFP to EdgeworthBox, they can select the suppliers they want to receive it, or they can let us handle the process. In the former case, we can also indicate to the buyer that some of the vendors they have chosen may not be appropriate, suggesting others who might be. Suppliers receive RFPs instantly, including those from potential new clients.

Third, we lower the cost for the buyer of generating the RFP. Using our central clearinghouse for data, the buyer can see two structured data repositories: a public repository and a private repository. Each repository contains live RFPs, historic RFPs, and historic contracts. On the private side, a buyer can see live RFPs (across all categories) they are working on EdgeworthBox, historic RFPs they have issued in the past along with the attendant supplier proposals, and historic contracts they signed. On the public side, they see the equivalent information for government data we have collected.

Now, for the item they seek to purchase, the buyer can collect SOWs they have issued and governments have issued previously, cutting and pasting the language into a rough first draft of the SOW for their own live project, editing it to fit the exigencies of the moment. The data is structured for easy use and our search function is excellent. They can do all of this without alerting any of the suppliers of their interest in a particular market.

Fourth, buyers have a sense for what they should be paying because they can see what they have paid in the past, as well as what governments have paid for the object of the RFP. We give them the equivalent of a “tape” from financial markets.

Fifth, buyers and suppliers have profile pages in which they can introduce themselves and their firms, including listing links to marketing content that buyers can obtain without filling out forms or otherwise revealing their intentions to buy. This marketing content can be used as a source of neutral market intelligence. It overcomes the restrictions some buyers put on visiting supplier websites. Suppliers may still want to list this marketing information to ensure that they see all of the relevant RFP deal flow.

Sixth, we have a social network that permits buyers to connect with other buyers for market intelligence. You can imagine Bob instructing one of his juniors, Dave Beatty, to reach out over our “Slack for Procurement” to other buyers of trucks to get general information about how to think about buying trucks, as well as potentially specific information about how these other buyers went about selecting different vendors in the past.

Seventh, we permit buyers to join up with other buyers to issue RFPs of greater scale and scope. In the case of larger buyers, they can hope to get better pricing through enhanced negotiating leverage. In the case of smaller buyers, they can hope to reach a level of critical mass that overcomes the costs for suppliers of submitting a proposal by forming an ad hoc group to purchase jointly.

Eighth, we bring more potential buyers to suppliers and more suppliers to buyers, with information and ready onboarding, expanding the opportunity set for both.

Ideally, the costs of submitting a proposal fall sufficiently to reduce the subjectively assessed likelihood of winning the deal required before submitting a proposal from 80% to 20% or 30%.

As an intermediate step towards full automation, we anticipate developing templates for common RFPs. In the case of the truck RFP, the buyer may adjust the tolerance for required fuel mileage or storage capacity, for example. Having templates means that suppliers would have templated responses as well because the RFPs would be substantially identical, again adjusting variables such as price and volume.

With full automation though, the process would be massively simpler, cheaper, and faster. The buyer would tell EdgeworthBox that they wanted an RFP for trucks. EdgeworthBox would ask a short list of questions related to parameters such as required mileage or capacity. EdgeworthBox would draft the SOW. The buyer would then edit it before posting it. This would require us to develop a model for writing a SOW by category. The rules specific to the organization would be separate, taken care of by the buyer’s procurement officer.

Then, suppliers would receive the RFP and EdgeworthBox would automatically generate the first draft of a response, having extracted the questions from the RFP and answered them based on a model trained for the supplier based upon their history.

Finally, EdgeworthBox would score and rank the finally submitted bids according to the framework in the RFP.

Full automation would collapse a process of weeks and months into hours and days.

In the limit, if it costs a supplier nothing to respond, they should respond to as many RFPs as possible. Finally, there would be no need for catalogs or sole source procurement as the marginal cost of executing an RFP on both sides approached zero. If EdgeworthBox can make that happen, then we can be used for the full spectrum of procurement.

HOW SHOULD YOU USE EDGEWORTHBOX?

If you have a procurement system in place, like an ERP module or a cloud-based service, use EdgeworthBox to supplement what you have and to re-engineer the business process rapidly.

If you are a mid-sized company without any real system, relying principally on email and spreadsheets, now is the time to put in place EdgeworthBox as a quick process discipline.

Implementation is quick and easy. The SaaS business model is a fraction of the costs of the large services, as you get only the functionality you need without any expensive, extraneous bells and whistles.

At the most elemental level, EdgeworthBox is the only solution in the marketplace that is designed to change the underlying business process of the RFP to make it into a workable reverse auction.

Every other solution in the market is predicated on the idea that the RFP process as it is used today with all of its well-known flaws is immutable.

EdgeworthBox is the only solution to take features from financial markets and graft them onto the hidebound, 19th century RFP business process.

We are the only one with this combination of features. We are the only one with a central clearinghouse of structured data. We are the only one with a social network linking buyers to other buyers.

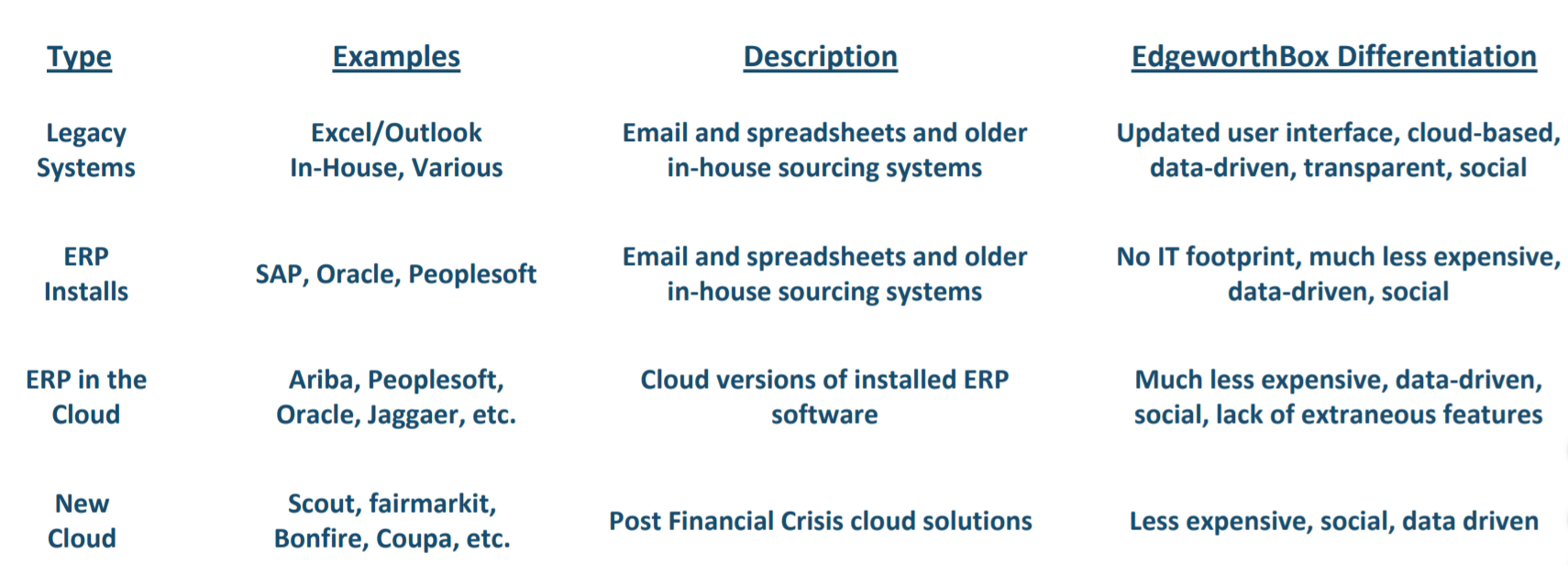

There are essentially four categories of solution used in common practice.

Our biggest competitor is the use of a combination of Excel and spreadsheets. Even for companies with ERP or other cloud systems, there are still enough issues porting data from one system to another or performing analytics that these basic tools are commonplace. Of course, they present tremendous risk. The data is vulnerable to employee turnover and security breaches. It is also going to be laid out in a way that does not lend itself to analytics. See this article we wrote on the topic for more depth.

When it comes to full automation, solutions tend to be experts systems approaches that try to code up the process used by an individual buyer. These approaches are functionally brittle and very difficult and time-consuming to develop; their specificity renders them certainly neither scalable nor extensible across buyers. It is difficult to gauge other approaches that claim the AI mantle as to the extent of their intelligence.

WHAT DO THE RESEARCHERS SAY?

The primary objective for companies is to make procurement more strategic. Historically, purchasing goods and service has been an administrative function. You can imagine fifty years ago that people would delegate purchasing to a clerical group buried in the operations area. Things have changed, but not as much as they should.

All this talk of improving the strategic value of procurement hearkens back to the tweet from Brian Laung Aoaeh at the beginning of this note.

The goal of 21st century strategy is to transform procurement into a function that can both improve supply chain margins and contribute to revenue growth.

Key obstacles to achieving this goal as identified by Ernst & Young include:

- Siloed information

- Siloed information systems

- Lack of data analytics

- Limited view into costs

- Difficulty adhering to procurement mandates

It is a simple fact that it is impossible to develop strategy, let alone implement it, without the right data. Even within an organization, there may not be a single repository of structured data in a common format. While theorists talk about a pristine “data lake,” too often procurement data exists in a series of disconnected cesspools of varying quality, much of it stuck in spreadsheets.

Supply Chain Dive wrote that “less than 10% of the data available to supply chains is effectively used by businesses. And most are virtually blind to the 80% of data that is dark and unstructured.” Dark data is a term that refers to orphaned information, untapped for business intelligence.

The last E&Y point appears to be a jargonistic euphemism for the way in which people softly rig bids, turning them into a pro forma compliance exercise and subverting the underlying principle of generating multiple bids in competition.

Geodis describes supply chain (including procurement) as central to strategy:

“Supply chain complexity has been growing due to the multiplication of players, sourcing channels, transportation modes and the geographical areas involved. In addition, specific local regulations or the varying levels of maturity exhibited by suppliers result in increased operational difficulties …

“At the crossroads of Strategy, Marketing, Sourcing, Manufacturing, Business Development, and Customer Services, Supply Chain has become the key strategic hub of companies’ activities.”

McKinsey presaged EdgeworthBox in 2017 by suggesting the following features for an improved procurement business process:

- Spend Visibility – understanding what the organization spends

- Collaborative Sourcing – tools that help teams collaborate internally can shorten category strategy development time by 30%

- Analytics – analytics solutions specialized for categories

- Cost Analysis – knowing what items “should” cost

- Supplier “X-Ray” – central location for data about suppliers

- User Experience – improved user experience the single biggest factor to foster adoption

- Performance Scorecards – assessing the performance of both buyers and suppliers

Top tier performers on the buy side take a collaborative approach with their suppliers. But they also do deep research into their category markets and they attract, develop, and retain talent. This latter issue is a vital challenge for procurement departments. Nobody grows up wanting to be a procurement professional. This may be especially true for younger workers.

Being more strategic means integrating procurement with product, sales, and marketing to ensure that these groups make their decisions cognizant of the best inputs. Without this kind of integration, they can make sub-optimal choices about inputs, in some cases massively increasing supply chain risk.

Strategy also means designing a system to save costs. Here is The Hackett Group on the use of a proper digital transformation to improve strategy and execution:

“Through full deployment of digital tools, typical procurement organizations can reduce operational costs by up to 45 per cent, achieving efficiency levels below that of today’s world-class procurement organizations while at the same time enabling them to improve effectiveness and customer experience, according to new research from The Hackett Group, Inc.”

As Ayming put it in a report on the future of procurement, “Procurement must continue to prove its worth beyond just delivering savings.” COOs and CPOs understand the strategic value of procurement, but there is still work to get CEOs and CFOs to see the light. Priorities highlighted for procurement reform include earlier involvement to create value in decision making and ongoing evolution to parallel the evolution of the firm.

Another report from The Hackett Group shows the benefits of optimizing procurement for those who are deemed to be world-class:

- Procurement influences 93% of spend (vs. 64% for the non-elite peer group)

- Generation of 75% more savings via cost reduction and cost avoidance

- Over 4 times as likely to be perceived by stakeholders as an integral and valued business partner

- More than 2 times as likely to be seen as expert

Buyers have several key priorities: reducing costs, reducing risk, and increasing competition for their business.

Another objective is for organizations to cut the costs of executing procurement. Currently this cost ranges from 0.1% to 0.6% of revenue before the deadweight loss from insufficient competition on price and service.

CONCLUSION

Companies can make changes quickly to improve their procurement processes by using EdgeworthBox (or the approaches we advocate in re-engineering the RFP) to supplement their existing approaches.

Come check us out for a free trial. Or give us a shout.