Buying goods or services for your business isn’t like buying things for yourself or your family. B2B buying is difficult.

When you consume things as an individual, you may do some research, but you have a need and you decide quickly. It’s not necessary to have a deep relationship with the sales team or the provider. You have a need and you satisfy it.

But things are different when you’re buying things for your company.

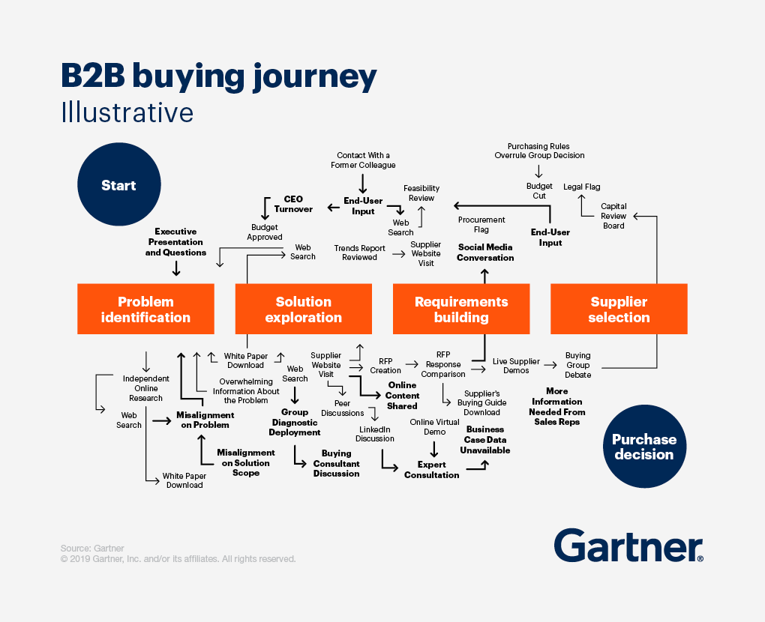

The Buyer’s Journey

First, it’s not just you. There is a group of people who are interested in the purchase. In addition to the end users, there are people in finance who want to confirm that you’ve paid the right price, others in corporate social responsibility who seek to ensure that the firm is considering a balanced set of suppliers, and there are others who seek to understand how this acquisition will affect their ability to execute. Not to mention the procurement staff who want to minimize the risk of “waste, fraud, and abuse” by complying with imposed processes. Each person in this group has an individual persona; each one has a different orientation. Vendors now have to sell in multiple dimensions.

The size and diversity of this synthesized buying group depends on the scale of the purchase, the complexity of products on the market, the strategic significance of the product being bought, and the prior experience with solutions in the relevant category.

Second, everyone in this group is skeptical. This is not the turn of the 21st century when the seller could call you up and ask, “How much can I put you down for?” Nor is it a world in which salespeople can afford to “always be closing.” All the buyers are wary of manipulation by vendors into purchasing something that isn’t an optimized fit for their problem or paying an inflated price.

Everyone in the group wants to feel as if they have made this decision independently, trusting their sentiment to confirm a reality in which they have made the right choice.

Third, not everyone in the group is sophisticated when it comes to the category in question. People have various levels of knowledge and experience. Some people may know a great deal, others may be new to the space.

Fourth, it is expensive to obtain category knowledge and market intelligence. Category knowledge refers to understanding the breadth of solutions available to tacking a particular problem. Market intelligence refers to comparing the offerings of various suppliers and understanding pricing to be able to assess value-for-money. It costs time and resources to hire a consultant with category expertise or to purchase research that helps you understand the landscape. And when buyers do bring in third parties, they (at least partially) outsource judgment and influence to even more individuals outside the organization.

Fifth, these individuals have different roles in the decision-making process, in addition to their functional positions. These separate roles carry different weights. Someone initiates the request, someone with an outsized voice, someone who controls the bureaucracy of the process (including the access to relevant information), someone who controls the purse strings, and someone who runs the buying process. These are all potentially different people. This is another source of complexity.

Sixth, at least on the face of it, there is an abundance of information online. This would appear to contradict the notion that it is expensive to obtain category knowledge and market intelligence. But, as with all digital content, one still needs to sift through a great deal of chaff to find the wheat.

Seventh, this takes time. The bigger the purchase, the greater the consequence is for the company’s bottom line and the longer the buying group will take to make their decision. This delays the implementation of the solution and the realization of the value of the procurement. Time is money.

A corollary aspect of this temporal aspect is that group members want to wait for as long as feasible before speaking with a supplier salesperson. This preserves the sense of independence. It also means that they can have an intelligent conversation when they do finally engage vendors.

“As hard as it has become to sell in today’s world, it has become that much more difficult to buy. The single biggest challenge of selling today is not selling, it is actually our customers’ struggle to buy.” – Brent Adamson, Distinguished VP, Advisory, Gartner

The buyer’s journey is complicated.

What Does This Mean for Suppliers?

Most importantly, salespeople should “always be helping.”

Practically, this means that suppliers should educate their customers on the problem, mapping it to the supplier’s solution. If it’s a match, then great. You’ll have a customer for life. If it’s not a match, then let them know. Even better, send them to someone who is.

Make it easy for them to discover your content online. In this material, make sure that you talk about the problem and then describe why the benefits your product delivers solve this problem.

Speak in plain English. Only bureaucrats like jargon.

There’s an old saying, “Time spent on recce is seldom wasted.” Smart buyers have begun to figure this out.

“A 2017 Gartner survey showed that 27% of time spent performing key buying activities is dedicated to independent online research. Only 17% of time is spent meeting with potential suppliers.”

Smart suppliers know that by the time they meet with a potential customer now, much of the decision is complete. Buyers use sales conversations for consulting as much as anything else in which they share their problem with the vendor to see if there is more nuanced, customized information to supplement what they have found independently.

According to Accenture, “Most customers are 57 percent through the buying process before the first meeting with a company representative.”

Buyers want “hyper-personalized” service.

Interestingly, “61 percent of all B2B transactions now start online. And 58 percent use social media as a research channel.”

What does the buyer want ultimately? They want to minimize regret: regret that they bought the wrong solution, regret that they paid the wrong price, regret that they used the wrong supplier, regret that they spent too much time and money on the buying process.

A good salesperson then helps the customer do the myriad jobs involved in the purchasing process so that the buyer can be sure of their decision.

We built EdgeworthBox to be a solution that helps both buyers and suppliers on their intertwined journeys. Our purpose is to cut through the bureaucracy, the friction, and the noise. If we get it right, we’ve enabled buyers to purchase the right solution, from the right supplier, at the right price. Also, we will have made it easier and faster for suppliers to sell and create long-lasting relationships.

We’re different than other tools buyers and suppliers use.

It’s free for buyers and suppliers to join to access our tools, data, and community. Buyers pay a small fee for executing purchasing transactions. Buyers can check out suppliers invisibly without triggering an avalanche of sales-y solicitation. We have a social network and we have repositories of public sector statements of work for rapid access to market research. We make it easy to vet the risk of counterparts with our standardized due diligence framework.

Give us a shout.