It’s an exciting time to be alive. It’s also a terrifying time to be alive. Exciting if you are at a startup, you’re young and unencumbered, and you have access to tools that make it easier than ever to build a product. Terrifying if you are a mid-career executive at a large corporation who worries that some kid in a hoodie will invent an AI product that will throw you out on the street, even as the message comes from on high that investors want innovation and they want it yesterday.

You can build it, you can buy it, or you can rent it.

Building it means hiring engineers and scientists to develop new products. Some established companies are very, very good at this. It is their core competence. Look at 3M: 50% gross margins, strong free cash flow generation, the US Government’s highest award for innovation, the National Medal of Technology. Scientists and end users collaborate to identify key problems and build products to solve them, even as in-house technical staff share ideas. They have a rule that says that 30% of revenue must be generated by products developed in the previous four years. This is in addition to doing longer term, fundamental research. 3M has created novel incentive and career structures, even seeding internal teams for new products with small, educated bets. Much has been written about Google’s free time they give to employees to pursue projects, but 3M has had its 15% rule for years. 3M scientists can spend 15% of their time on projects that interest them.

Here’s the rub. Not every company can be 3M. In fact, 3M is extraordinary for having the scale and the culture to make this happen.

What’s a big behemoth to do? CBInsights has a great profile of things not to do. These include paying someone to set up a corporate accelerator so that you can source innovation, engaging in corporate venture capital, emulation of what you think startups do, etc. If your firm cannot be 3M, then you buy or you rent (say, with a SaaS license).

Large corporations have lots of internal and external customers who, in turn, have lots of problems. What they may not have is the culture of innovation to be able to do it internally, or the resources to make it happen systematically.

This is a matching problem: pairing startups that have solutions with corporations that have problems.

Corporates seeking innovation can either passively wait for it to come to them, or they can solicit it actively.

Waiting passively doesn’t typically work. Imagine you are the head of innovation for a bank. Frequently, you receive unsolicited proposals from startups who have built products. The only thing is that these products likely don’t have anything to do with your problems because the startups don’t understand your context. So, you waste a lot of time saying no.

Active solicitation means spending a lot of time hunting for startups whose products could solve your problems. This may not be terribly efficient. This is the motivation for corporate venture and corporate-sponsored accelerators. The problem is that the corporate wastes a lot of time and money in the hunt, with not much to show for it.

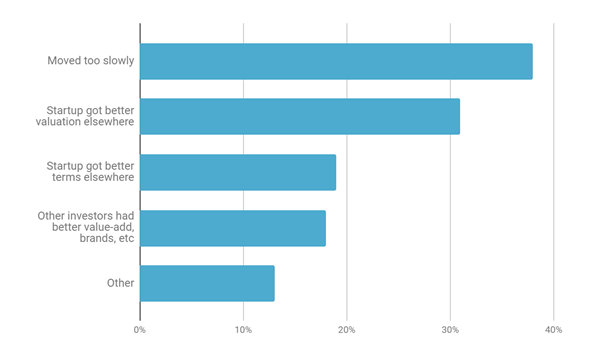

Here’s a chart from CBInsights describing the obstacles corporate VCs need to overcome from their State of CVC report:

Ideally, what you would like is to vet only those startups that understand your problem set (or, at least, the outline its outline).

This is perfectly suited for a marketplace of, ahem, ideas.

Imagine that a corporate buyer could post a “challenge” describing in as much or as little detail the problem they wanted to solve, without over-specifying what a solution would look like, to a marketplace where the suppliers were all startups. They don’t need to be from your industry, either. A startup in industry X may have come up with a product that solves a problem in industry Y without any knowledge of it. Just tell the startups what the desired outcome should be. For example, if you were a bank, you may say that you would like a solution that detects patterns (fraud) in large sets of data of a particular form: anti-money-laundering due diligence questionnaires. You will attract more potential responses from companies that specialize in AI, generally, than if you go just to companies that specialize in fraud.

EdgeworthBox is a cloud-based managed marketplace that can enable corporate buyers to source innovation from startups with a focus on outcome-oriented procurement. This is a faster way to access new products with a wider aperture, lower transactions costs, and lower risk than setting up a corporate accelerator or a corporate venture arm. Also, our social networking can promote collaboration across buyers. Come check us out or sign up for a free trial.